20000 shares X 112th of year X 11 stock dividend X 3 stock split 5500 shares On October 1 st the company takes 4000 out of treasury stock and reissues them to the public. A 3-for-2 stock split is the same as a 50 stock dividend. Here are the steps to calculate the weighted average of the number of shares outstanding based on durations stated in the number of days.

Thus the weighted average shares calculated at the end of the year stand at 25000 shares plus 82500 shares ie 107500 shares.

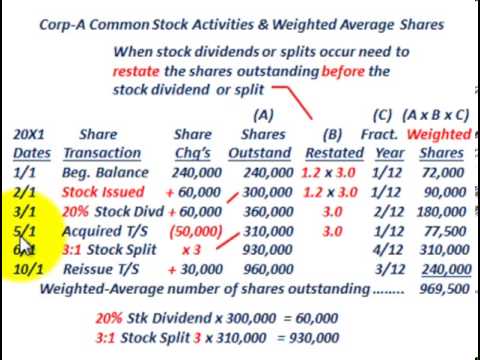

To calculate the weighted average cost per share the investor can multiply the number of shares acquired at each price by that price add those values and then divide the total value by the total. These shares are non-dilutive because they do not include any options or securities that can be converted. 31 210000 212 35000 Weighted-average number of shares outstanding 180000 L O 4 58. Stock Dividends and Stock Splits Weighted-Average Share Calculation Dates Outstanding A Shares Outstanding B Restatement C Fraction of Year D Weighted Shares A B x C Jan.